Our client has worked for over 25 years to become one of the United Kingdom’s leading choices for automotive performance parts and tuning services. With its own shop and fully-equipped workshop, the team is entirely devoted to providing a fast, high-quality service.

They are trusted by worldwide car brands to provide performance parts.

R&D Background

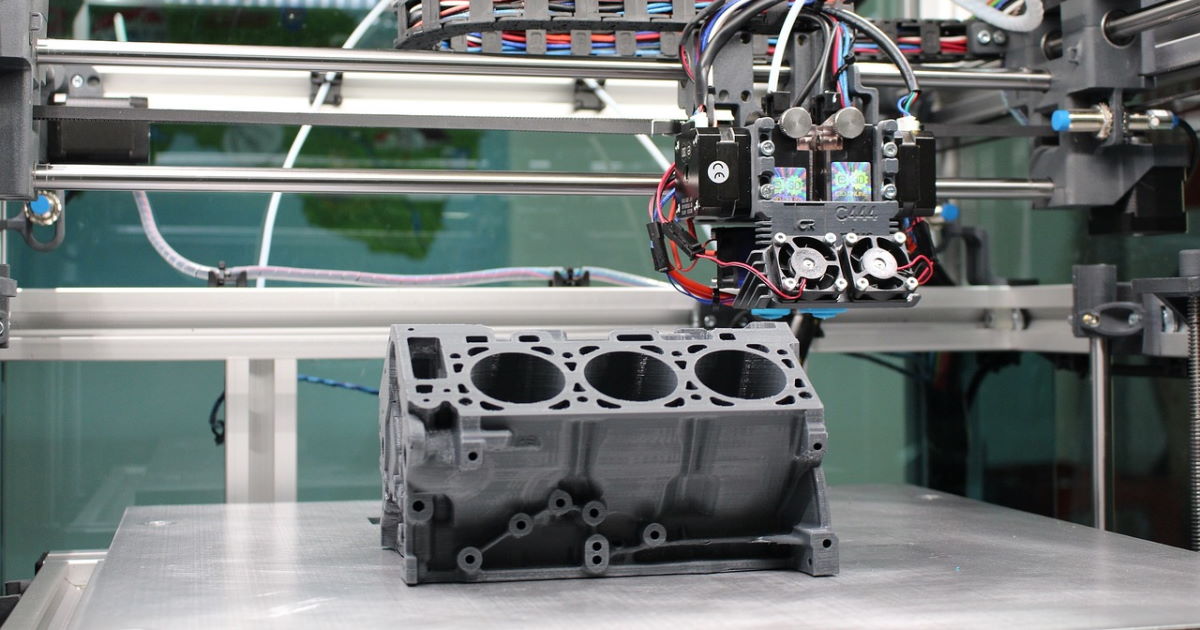

- Redeveloped engine components to notably improve performance

- Developed new turbos and ECU software that could be used on a wide range of cars

- Developed a bespoke turbo to improve performance

- Developed a custom fuelling solution to drastically improve vehicle performance

- Developed new engine management software to improve performance

- Developed tuning boxes which could be retrofitted to performance vehicles

R&D Claim Amount – £250,000

The client was introduced to us through their accountant because we have access to people who specialise in R&D tax credit claims. After speaking with the client, we calculated that they could benefit from over £250,000 of tax relief.

The application was successful and the client received the credit in their account.

Furthermore, the client has subsequently referred more clients to us and has received a referral bonus for each one.

What They Received

All of our clients are assigned a dedicated R&D tax analyst to process the claim. As part of the process, we have ex-HRMC inspectors, IP/patent lawyers, industry-specific professionals and Innovate UK specialists that we can call on.

All tax credit applications are fully compliant with HRMC and come with a 12-month guarantee.

The fees are low and do not need to be paid until the money is credited to the client’s account (there are no upfront fees).

For more information visit our Research & Development Tax Credit page.