Are you a UK farmer who needs quick access to affordable finance to source new agricultural machinery or vehicles, to expand your livestock holding or to buy land or farm buildings?

Are you struggling to decide the best route to access finance or a loan to help fund and grow your agricultural business?

Evangate FS take the hassle out of sourcing finance for the agricultural sector.

Contact us today and let us arrange a great deal for you.

Borrow up to

100%

OF THE NET ASSET COST

spread the cost

12 to 84

months

BEST DEALS FROM

150+

APPROVED LENDERS

QUICK QUOTES

24-48

& FAST DECISIONS

deal with

1

person from start to finish

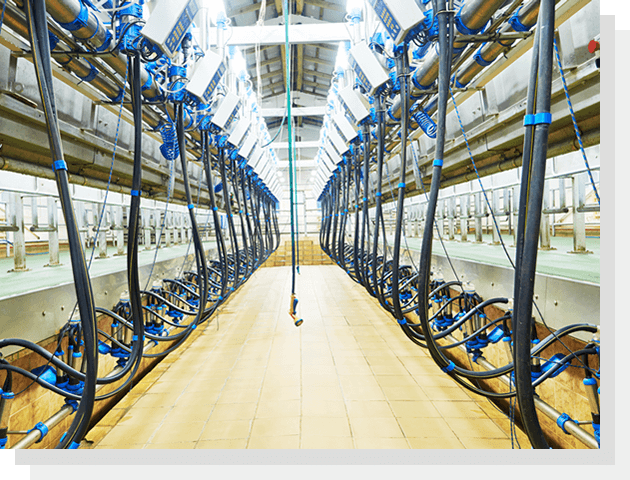

Agriculture finance offers flexible options to buy farm machinery or vehicles, expand livestock holdings, purchase land or secure loans for farm buildings.

Evangate FS are one of the UK’s leading brokers of agricultural finance for farmers in Scotland, England, Wales and Northern Ireland.

We know that running a farm and looking at ways to minimise costs and increase your profits is not an easy task.

That is why UK farmers trust us to get them the best finance deal we can. Many farmers who we help have become repeat customers and friends.

They rely on us to arrange finance or loans for a range of agricultural assets – everything from chicken pullets, tractor finance to agricultural mortgages.

We can source great deals on almost every type of agri finance.

Finance can be arranged for new or second hand farm machinery with no age limit*.

Whether you are looking to use hire purchase, lease or lease back agreements, we can advise you on the best options to secure the machinery you want.

Finance for agriculture machinery includes, but not limited to:

Loans to construct new agri buildings or to extend or repair existing structures are available at affordable rates.

Evangate Financial Services have access to lenders who specialise in offering financial solutions to farmers so they can expand their agricultural buildings. Examples include:

Evangate can offer finance for all types of new and used vehicles used around the farm. Everything from quad bikes to commercial vehicles and trailers.

There are a wide range of agri finance options available to you – hire purchase, operating or finance lease, and conditional sale to lease back agreements.

Speak to our specialists in UK vehicle finance today and we can advise on the best option for you.

We can also help source your new vehicle as a significant discount over your local dealer.

We can arrange finance for most agricultural businesses no matter their financial status. If you happen to have a poor credit rating, speak to us today to see how we can help.

If you have the opportunity to purchase land, then you will often need quick access to finance to complete the purchase

We have been assisting UK farmers to increase the acreage of their farms by arranging flexible mortgage loans over the past 10 years.

There are a range of options available from the High Street, challenger banks and independent finance companies.

Give our team a call to discuss your requirements, put us to the challenge to see if we can help you quickly increase your investment in agricultural land.

Livestock is literally the life blood of many farms. We have access to lenders who specialise in finance for buying livestock.

This means you can get quick access to funds, for example, for auction purchases.

Contact Evangate Financial Services now so we can explain the options available – so you don’t have to use up any valuable cash reserves or use an expensive bank overdraft facility. We can help with:

When you want to use better equipment to maximise the investment in your farm, then Evangate will take the hassle out of arranging finance to allow you to purchase agricultural equipment.

Investing in new equipment will improve your productivity and profits and make your life a bit easier.

We have access to over 150 lenders so we secure you the best deal on equipment finance we can. Here a few examples of equipment we can help with:

As farmers, your specialty more likely to be nurturing your animals, growing crops and harvesting to provide for the nation.

It’s unlikely to be in finance. We have answered some of the common questions we get asked:

There are a range of finance options available depending on what you need the finance for. It is best to speak to an experienced broker as they recommend an option which offers lower rates and lower repayments.

Here are six to consider:

The agricultural sector has been getting squeezed over the years often experiencing lower margins on their produce.

Whereas, the cost of operating a farm requires cash injections for a variety of reasons, such as, allowing farmers to replace machinery, invest in new energy efficient solar panels, build new stores, purchase cattle etc.

For most farmers, accessing finance through traditional lenders such as banks is becoming more difficult and time consuming.

Using a specialist agriculture finance broker such as Evangate FS, can offer farmers preferential rates and flexible arrangements – and often much quicker financial support.

We understand the farming community and how important it is for you to have access to reliable machinery and vehicles, to buy livestock or simply to unlock the potential of your farm assets.

With over 10 years experience in arranging agricultural finance and loans, our team are ideally placed to help you.

Leave it to us to take the hassle out of arranging finance.

1

After a quick call to gather some information about the agri finance that you want, we’ll get to work on sourcing the best deal for you.

Start by completing the form or by calling us now.

2

We understand that when securing agriculture finance, time is of the essence.

We will have a decision in principle to you within 24 hours** of receiving the necessary documentation.

3

We guarantee to provide you with a personal and friendly service.

This allows us to really get to know your business and focus on developing a strong, long-term relationship with you.

We can provide finance to most farmers no matter their financial status.

If you happen to have a poor credit rating, speak to us today to see how we can help.

Kyle first sorted out a finance deal with me over a year ago when I bought some machinery from a Scottish dealership.

I was very happy with the service Kyle provided and since then I have used him to finance various other items of machinery!

He’s great to work with and I would highly recommend his services!

Would highly recommend using Kyle for any finance services you need.

He is extremely efficient, always finds competitive rates and goes the extra mile to get things completed in a matter of hours.

We always use Kyle and will continue to do so with future business!

Would highly recommend Kyle for any finance requirements!!

He has a wealth of knowledge within the industry and wouldn’t go anywhere else, always finds the most competitive rates on the market and constantly keeps you informed throughout the process!!

Great customer service.

To receive a free no obligation finance quote, contact us now by completing the form above or by calling us on 0800 488 0230.

(Telephone lines are open between Monday to Friday, 8am to 6pm)

*The maximum age limit on assets is 25 years at the end of the agreement.

**Terms and Conditions apply – our finance specialists in the UK will explain the options available when we speak with you.

Quantum House Business Centre

2 Stoneycroft Road,

South Queensferry,

EH30 9HX

Tel: 0800 488 0230 or 07950 932190

Email: kyle@evangatefs.com

Evangate Financial Services Ltd is a credit broker not a lender.

Evangate Financial Services Ltd is registered in Scotland no. SC583768 and is authorised and regulated by the Financial Conduct Authority, reference FRN846182.