We successfully helped this mould & pattern making company claim over £70,000 in R&D Tax Credits.

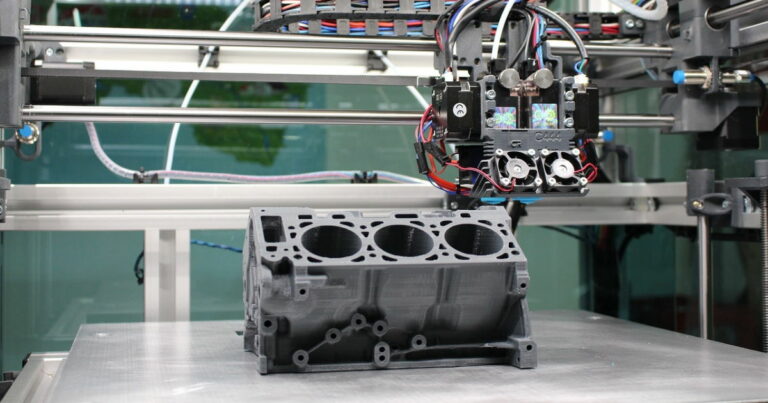

After working with one of our preferred R&D tax partners, an R&D Tax Analyst discussed with the senior management how they improved their in-house injection process of making patterns for the hot metal and glass industries, as well as, vehicle manufacturers.

They also uncovered that the company produce moulds for the precast concrete industry which are used by well-known developers and cast stone manufacturers.

R&D Background

- Manufactured bespoke tooling to improve the efficiency of producing baths

- Designed and produced a new type of roof for campervan conversions

- Designed and manufactured new moulds for front bumpers/splitters for transporter-type vans

- Manufactured new roofs for long wheel-based vehicles (first of its kind)

- Created new patterns and moulds for coin-operated fairground rides

R&D Claim

The company owners were unaware of what investment and time could be claimed. They believed their processes fell under the guise of everyday operational tasks.

After the R&D Tax Analyst discovered the level of “hidden invention” that had actually been invested in, they were able to process a claim for over £70,000.

No Upfront Fees

As with all R&D claims undertaken by this particular partner, there are no upfront fees to pay until the claim is successfully processed and the funds are deposited into the client’s bank account (or issued as tax relief).

This partner is also unique, in that they offer a 12-month guarantee against any HRMC investigations within that timeframe. Backed by their in-house ex-HMRC inspectors – they are confident in their abilities to have claims processed successfully.

If you would like a free no-obligation consultation to discover if your business can claim tax credits for any innovative projects you have delivered, please complete the form below.